Foreclosures

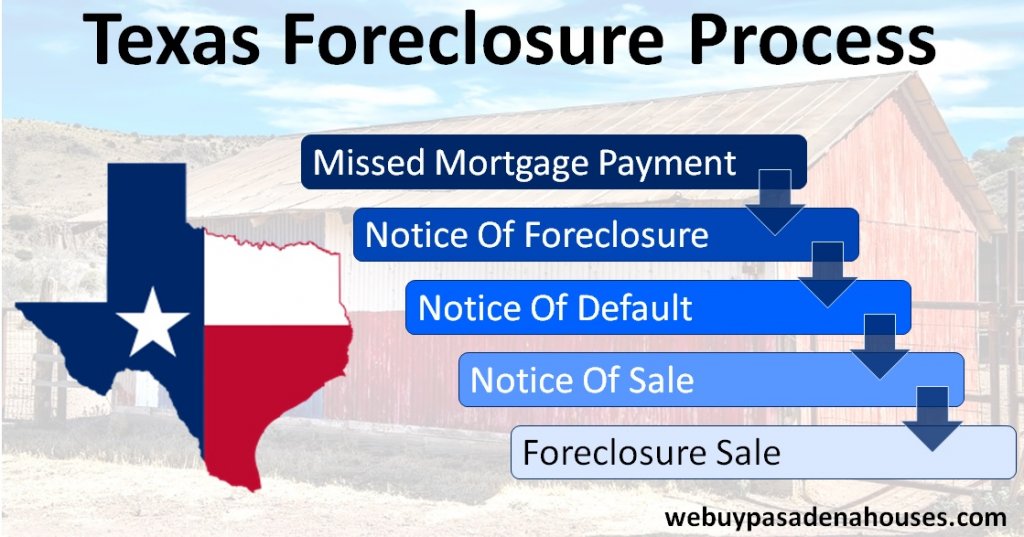

Foreclosure is scary for any homeowner. It happens when a mortgage borrower stops making payments on the loan.

Because the loan is secured, meaning that the property serves as collateral for the amount borrowed, the bank can recover the debt by seizing the home and selling it.

In Texas, this process tends to happen very quickly. Texas foreclosure laws are such that the minimum time frames between notices are shorter than they are in most other states.

So, how long does the foreclosure process take in Texas? For that matter, how does foreclosure work in Texas?

Let’s examine it step by step.

Missed Mortgage Payments

Foreclosure begins with missed mortgage payments. If you haven’t made your payments for a couple of months – sometimes even for just a single month – the lender will start to send you letters and make phone calls. If you can, treat these as opportunities to work out payment plans or loan modifications to get your loan up to date.

How Long Do You Have?

According to the federal law that regulates banking, you must be delinquent for 120 days before a lender can serve you with a notice of foreclosure. However, there are some independent lenders that do not fall under this law’s jurisdiction and can begin foreclosure at any time after the loan goes into default.

Notice of Default

If the lender chooses to proceed with foreclosure after the minimum delinquency period has passed, they can send you a notice of default. This means that you have a specified period of time, usually a legally mandated 20 days but occasionally up to 30 days, in order to pay what you owe.

Notice of Sale

If you have not yet arranged to pay your amount due within the time specified, your lender may send you a Notice of Sale. Foreclosure rules in Texas require that you have at least 21 days’ notice in writing, beginning on the day the notice goes into the mail, before the lender sells your home at auction.

The lender must also post the Notice of Sale at the door of your county courthouse and file it with the clerk of that county. All notices must include the location, date, and time of the planned sale. They must also include a request to disclose military status, as special rules may apply under the Servicemembers Civil Relief Act.

Foreclosure Sale

In Texas, foreclosure auctions take place at the courthouse for the county in which the property is located. They happen on the first Tuesday of every month and may be scheduled any time between 10 AM and 4 PM. The law requires that the sale begin no earlier than the time listed on the Notice of Sale and no more than three hours thereafter.

The proceedings will involve a representative of the lending entity. State law permits the lender to purchase the home as the highest bidder at auction. In bidding, the lender receives as credit the value of any outstanding debt on the mortgage.

What You Might Need To Pay After the Sale (Deficiency Judgment)

The nightmare isn’t over after the your house is sold. Yes, you’ve lost everything you’ve put it at this point, but it might not be the end.

Foreclosure rules in Texas allow lenders to secure a deficiency judgment after foreclosure. A deficiency can happen even if the house is sold at full price.

For example, if the borrower owed $150,000 on the mortgage and the home sold for $150,000, however during the foreclosure process, a total of $25,000 foreclosure costs and legal fees was incurred. So there is a deficiency of $25,000. You are not liable for this extra cost.

Texas lenders may use legal action to recover this deficiency, provided that they file the appropriate lawsuit against deficient borrowers within two years of the foreclosure auction.

Conclusion

In conclusion, the earlier to take action in the foreclosure process, the better it is for you.

You’ll get to minimize unnecessary costs and expenses, not to mention the unwanted stress and hassle.

As long as you have not reached the Foreclosure Sale stage, you should contact us to find a solution.

Get Help Now (Don’t Lose Your House)

We Can Pay Cash For Your House And Help You Get On Your Feet. Do Not Let The Mortgage Take All Of Your Hard Earned Equity. Start below by giving us a bit of information about your property or call (713) 766-0442...